On June 16th, the 2024 China (Chongqing) Unicorn Conference was successfully held, during which the Great Wall Strategy Consultants released the "2024 China Unicorn Enterprise Research Report". The report reveals that by 2023, the number of unicorn enterprises in China had reached 375, with the Guangdong-Hong Kong-Macao Greater Bay Area hosting 70 of these unicorns (including one in Yunfu), accounting for 18.7% of the national total. Notably, the region also leads the country in the number of super unicorns — enterprises valued at over $10 billion — with 12 such enterprises nationwide, five of which are in the Greater Bay Area. This represents 42% of the national total, securing the region's top position in this category.

Unicorn enterprises are defined as privately held startups valued at over $1 billion and established within the last decade. Super unicorns are those with valuations exceeding $10 billion. These enterprises are predominantly in the high-tech sector, particularly the internet industry, and are seen as crucial indicators of new economic development.

In 2023, the Greater Bay Area's 70 unicorns (including one in Yunfu) were collectively valued at $269.75 billion. The five super unicorns in the region include SHEIN, WeBank, Cainiao, GAC Aion, and Lalamove. The region also saw the emergence of 11 new unicorns, accounting for 15.3% of the national increase.

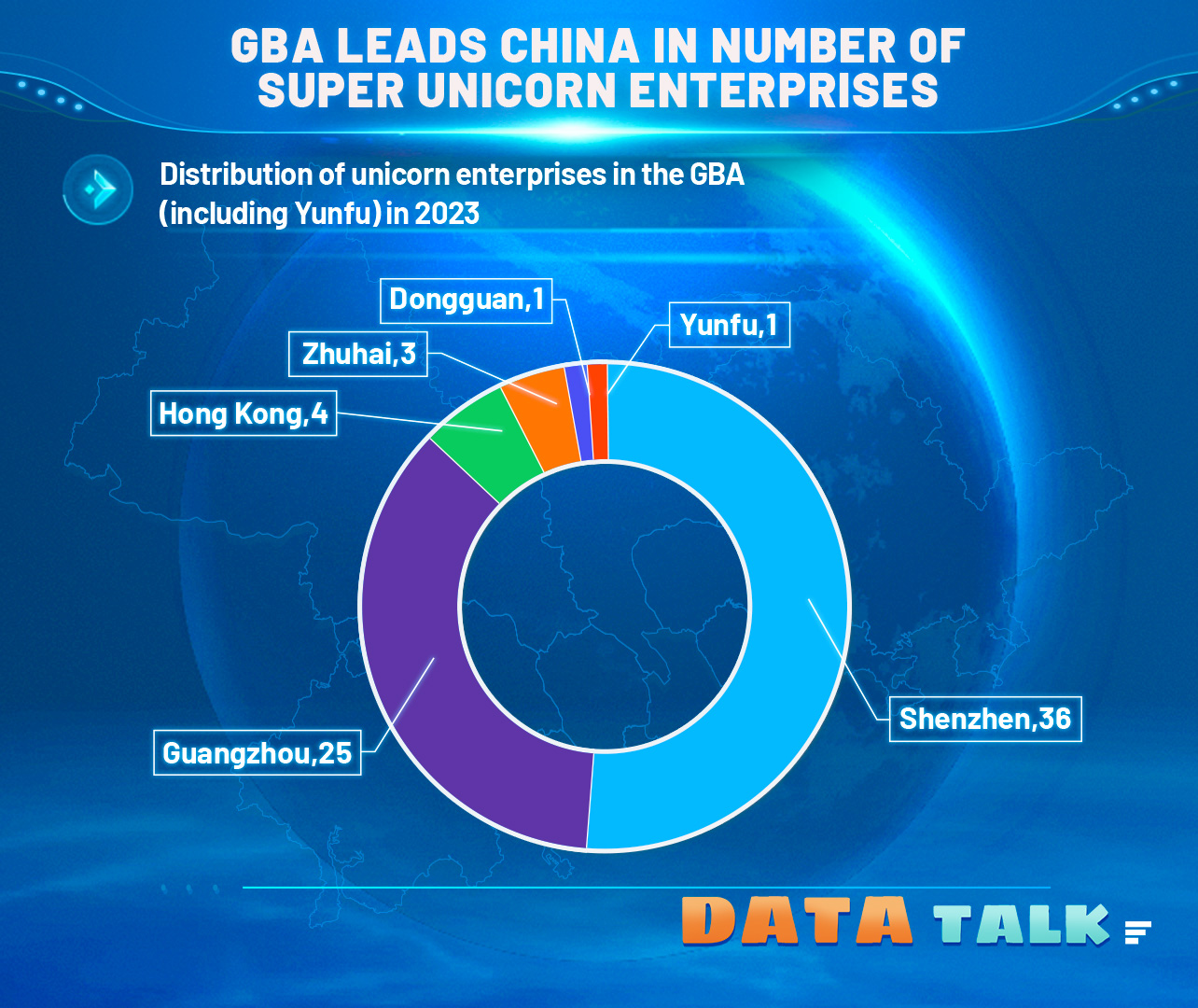

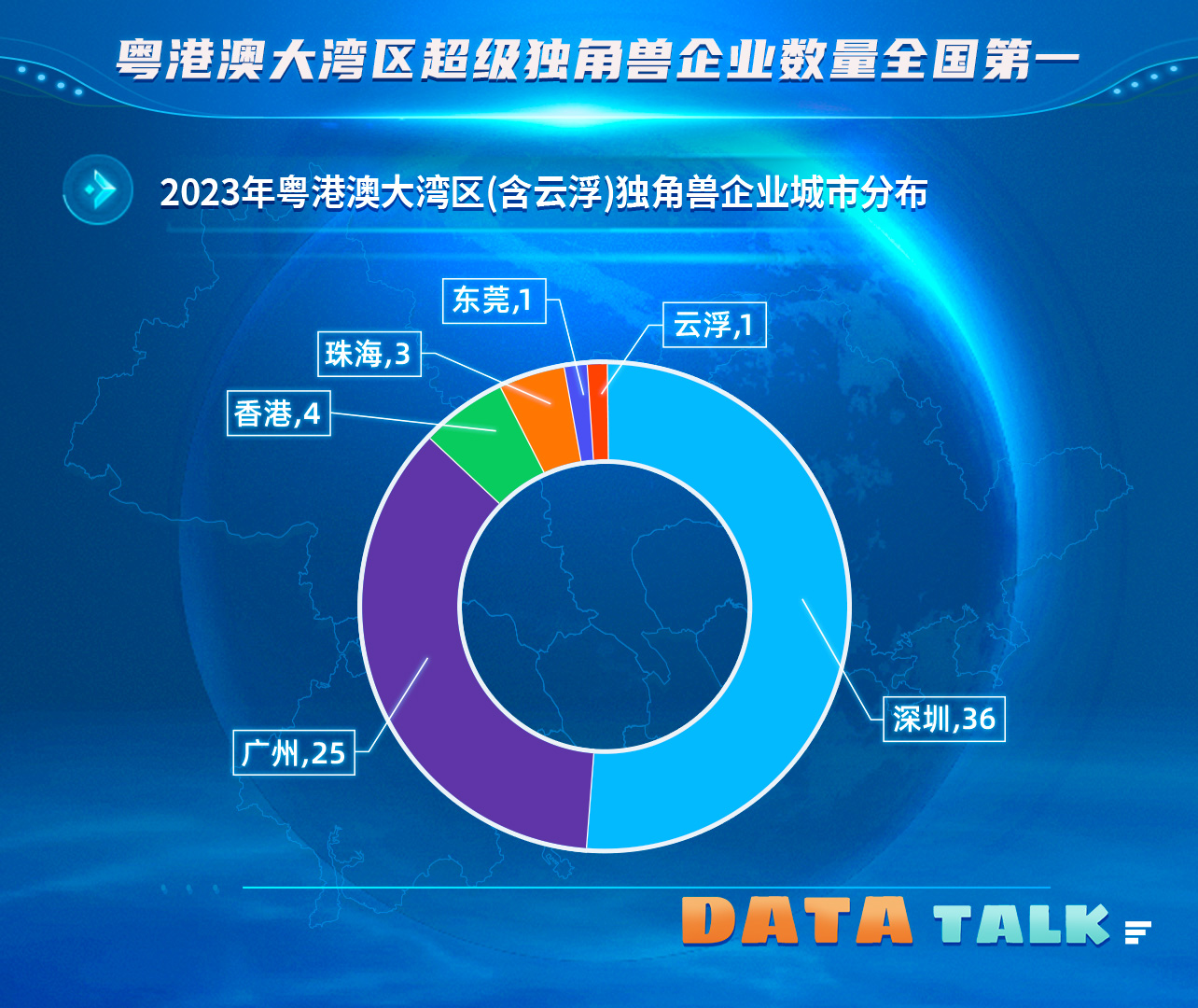

The distribution of unicorns within the Greater Bay Area is primarily concentrated in Shenzhen (36 companies) and Guangzhou (25 companies), ranking third and fourth nationwide respectively. Additionally, Hong Kong is home to four unicorns, Zhuhai has three, and Dongguan and Yunfu each have one. The new unicorns of 2023 are spread across four cities in the region: five in Shenzhen, four in Guangzhou, and one each in Hong Kong and Zhuhai.

The GBA unicorns are distributed across 31 sectors, with a continuous emergence of hard-tech unicorns. The highest concentrations are in integrated circuits, new retail, and innovative drugs, each having more than five enterprises. The 11 new unicorns are primarily in the sectors of integrated circuits (2), innovative drugs (2), digital entertainment (2), enterprise digital operations (1), robotics (1), intelligent flight (1), smart hardware (1), and fintech (1).

Notably, Guangzhou's unicorns have surpassed Shenzhen in overall valuation for the first time. In 2023, Guangzhou had 25 unicorn enterprises with a combined valuation of $128.1 billion, and they are primarily distributed across 18 sectors including new retail, automotive services, autonomous driving, trending products, and digital entertainment. The new retail and automotive services sectors each have three unicorns.

Guangzhou has seen a significant emergence of unicorns in the new energy vehicle (NEV) sector. In 2023, Guangzhou gathered eight unicorns in automotive and mobility-related sectors, which account for 32% of the city's total. They engage in areas such as NEVs, power batteries, autonomous driving, automotive services, and intelligent flight. Among them, GAC Group accelerated its platform development, spawning two unicorns: GAC Aion and Greater Bay Technology. Pony.ai and WeRide have become global leaders in autonomous driving innovation, leveraging Guangzhou's testing scenarios. Huasheng and Batulu have empowered traditional automotive services with digital technology, while XPeng AeroHT is developing smart electric flying cars to expand new urban low-altitude travel options. Unicorns in new consumption sectors are thriving. In 2023, Guangzhou saw seven unicorns in the fields of new retail, trending products, and digital entertainment, and they make up 28% of the city's total. The digital entertainment sector welcomed two new unicorns: Kuro Game and Quwan.

Several unicorns in the GBA have attracted significant capital investment, achieving substantial growth. In 2023, three unicorns in the GBA went public, and five potential unicorns advanced to unicorn status.

Source :Yangcheng Evening News

粤港澳大湾区超级独角兽企业数量全国第一

6月16日, 2024中国(重庆)独角兽大会顺利召开。长城战略咨询发布了《中国独角兽企业研究报告2024》。报告显示,2023年中国独角兽企业数量达到375家,粤港澳大湾区独角兽企业达70家(含云浮1家),占全国的18.7%。估值超过(含)100亿美元的超级独角兽达12家,粤港澳大湾区超级独角兽企业数量5家,占全国的42%,数量位列全国第一。

独角兽企业是指成立时间不超过10年、估值超过10亿美元的未上市创业公司,而超级独角兽则是其中估值超过100亿美元的佼佼者。独角兽企业主要在高科技领域,互联网领域尤为活跃,被视为新经济发展的一个重要风向标。

023年,粤港澳大湾区独角兽企业数量达到70家(含云浮1家),整体估值达2697.5亿美元。其中,估值超过(含)100亿美元的超级独角兽企业达5家,数量位列全国第一,分别为SHEIN、微众银行、菜鸟网络、广汽埃安、货拉拉。新晋独角兽企业11家,占全国的15.3%。

数据显示,粤港澳大湾区独角兽企业主要分布在深圳(36家)和广州(25家),总量分列全国城市第3位、第4位。此外,香港4家、珠海3家,东莞、云浮各1家。2023年,粤港澳大湾区新晋独角兽企业分布在4个城市,其中,深圳5家、广州4家,香港、珠海各1家。

大湾区独角兽分布于31个赛道,硬科技独角兽持续涌现。粤港澳大湾区独角兽企业分布于31个赛道,其中集成电路、新零售、创新药赛道企业集聚程度最高,均拥有5家以上的企业。11家新晋独角兽企业主要分布于集成电路(2家)、创新药(2家)、数字文娱(2家)、企业数字运营(1家)、机器人(1家)、智能飞行(1家)、智能硬件(1家)、金融科技(1家)8个赛道。

值得注意的是,广州独角兽企业整体估值首次超过深圳。2023年,广州独角兽企业25家,整体估值达1281亿美元,主要分布于新零售、汽车服务、自动驾驶、网红爆品、数字文娱等18个赛道。其中,新零售和汽车服务赛道聚集的独角兽企业数量最多,分别为3家。

广州新能源汽车相关赛道独角兽企业集中涌现。2023年,广州在汽车及出行服务相关赛道集聚8家独角兽企业,占全市总量的32%,包括新能源汽车、动力电池、自动驾驶、汽车服务、智能飞行等赛道。其中,广汽集团加速平台化发展,孵化出广汽埃安与巨湾技研两家独角兽企业,小马智行、文远知行依托广州自动驾驶测试场景成为全球领先的自动驾驶创新企业,华胜汽修、巴图鲁以数字化技术赋能传统汽车服务业态;小鹏汇天打造智能电动飞行汽车,拓展城市低空出行新方式。新消费相关赛道独角兽企业蓬勃发展。2023年,新零售、网红爆品、数字文娱等新消费领域集聚7家独角兽企业,占全市总量的28%,其中,数字文娱赛道新晋独角兽企业2家,分别为库洛游戏、趣丸。

粤港澳大湾区多家独角兽企业受到资本青睐,实现能级跃升。2023年,粤港澳大湾区3家独角兽企业上市毕业,5家潜在独角兽企业晋升为独角兽企业。

文|新快报记者 王彤

译|刘佳慧

海报|黎杰文

图|资料图

-

Post-90s man in Zengcheng: Chef during the day and dragon head sculptor after work!

2024-06-19 23:04:55 -

Chinese electric vehicles surge in Thailand,BYD targets 150 stores in Thailand this year

2024-06-19 23:05:13 -

Analysis: Putin's visit to DPRK raises Western concerns

2024-06-18 23:30:45 -

Santai Biotech: Moving from Kansai to Tokyo for 'openness' and "information"

2024-06-18 08:53:42